The cost of auto college for a student can really add up. According to recent data compiled by Bankrate, the average cost of full coverage auto insurance for an 18-year-old driver included on their parents’ policy is $1,975 per year.

That’s an annual increase of about $300 compared to the cost of the same auto insurance policy for a driver aged 40. College students who purchase their own policy could spend as much as $5,335.

Due to sticker shock, many people opt for less coverage than they need. Attempting to cut costs by decreasing liability limits may end up costing more in the long run.

A common way for parents to cut costs is to decrease their liability limits, which leaves their children vulnerable. It’s possible that a student’s policy, once they’ve graduated from their parents’ college, will provide much less protection in the coverage of a liability than their parents’ plan did.

It’s possible to cut costs on auto insurance for college students and their families in a number of ways that won’t compromise coverage. Some advice is provided below.

Should College Students Have Their Own Auto Insurance Policies?

As a young school heading off to college, you may be wondering if you really need your own auto insurance policy.

College students who purchase their own insurance policies typically pay higher premiums than their counterparts who enroll in their parents’ plans, even though the coverage they receive is equivalent. This is due to the fact that younger drivers typically incur higher costs and are not eligible for as many discounts as their more senior counterparts.

For financial reasons, sending a teen out on their own can be quite costly. Instead of just one young driver being rated, the risk is divided when both the parents and the child are rated on the auto policy.

According to Bankrate data, a full coverage auto insurance policy for an 18-year-old with their own vehicle costs nearly $4,000 per year with GEICO and nearly $6,000 with Allstate.

In most students, it is preferable for a student to remain on his or her parents’ health insurance plan. In many cases, having them covered by their parents’ insurance policy is the most cost-effective option. The situation may be different, however, if they have a checkered driving history that includes incidents like a DUI.

Whether or not you need your own auto policy while attending school is largely determined by where you plan to live and who will be driving the car. You need to have your own car insurance policy if your name is on the title.

However, if your parents’ names are on the title or the car is titled jointly with them, you should remain on their policy until you can afford your own. If you own a car in the United States, all but two of them require you to have car insurance.

Our Picks for the Best Cheap Car Insurance for College Students

While there is no one “best” auto insurance for students, we believe the following policies should be seriously considered. Remember that the listed rates are based on children covered by their parents’ policy. Getting your own auto insurance policy will cost you thousands of dollars more annually.

Nationwide

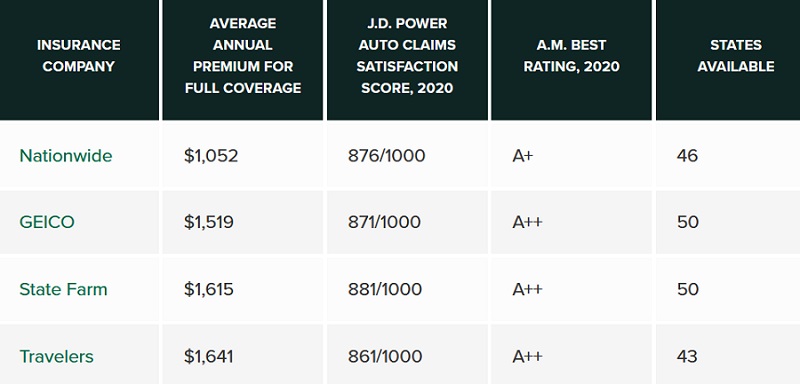

Nationwide has affordable auto insurance rates for young adults. An 18-year-old car adding themselves to their parents’ Nationwide auto insurance policy can expect to pay $1,054 per year for full coverage.

Its low prices make up for the lack of student discounts. College students between the ages of 16 and 24 with a B average or higher are eligible for the company’s student discount.

Nationwide Student Discounts

- Good student discount

GEICO

College students can save money by purchasing auto insurance from Geico due to the company’s low rates and numerous discounts. College students can reduce the average annual cost of full coverage auto insurance with Geico by asking for discounts.

This average cost is $1,519 for a car under the age of 18 who is included on their parents’ policy. Geico offers discounts for good students, drivers-education graduates, and members of select organizations. Students can save up to 15% yearly on auto policy with Geico by qualifying for the college’s Good Student Discount.

GEICO Student Discounts

- Good student discount

- Fraternity, sorority, and honor society membership discounts

- Alumni associations, colleges, universities, and student organization discounts

- Driver training discount

State Farm

Among State Farm’s many auto insurance discounts, those for student drivers stand out as among the best. Full coverage car insurance with State Farm costs students about $1,615 annually.

Students between the ages of 16 and 25 with a cumulative GPA of at least 3.0 can receive up to 25% off their State Farm auto insurance premiums, the highest good student discount available. Students who will be attending a college or university more than 100 miles from their home may be eligible for a student away at school discount.

State Farm Student Discounts

- Good student discount

- Distant student discount

- Driver training discount

The Travelers Companies

Costing an average of $1,641 annually, full coverage auto insurance with Travelers for a car aged 18 who is listed on their parents’ policy is a significant investment. While that’s on the high end, students can save a lot of college with Travelers’ various discounts.

For young drivers, Travelers provides a driver training discount in addition to good student and long-distance student discounts. In order to qualify for Travelers’ good student discount, students need to be in the top 20 percent of their class or have a grade point average of B or higher. In order to qualify for Travelers’ long-distance student discount, college drivers must be attending school more than 100 miles from home.

Travelers Student Discounts

- Good student discount

- Distant student discount

- Driver training discount

Best Cheap Car Insurance for College Students of 2021 Summary

Car Insurance Discounts for College Students

Asking your auto insurance provider about available discounts is a great way to save money on what would otherwise be a very expensive policy. There are common discounts that college students can take advantage of:

Vehicle Discounts

- Anti-theft discount

- Anti-lock brake discount

- Passive restraint discount

- Hybrid/electric vehicle discount

- New car discount

- Low mileage discount

Policy Discounts

- Multi-policy discount: You have multiple insurance policies with the same company.

- Full payment discount: You pay your entire year premium at once.

- Safe driver discount: You go a prolonged period of time without claims or accidents.

- Customer loyalty discount: You’ve been a loyal customer for a certain amount of time.

Student Discounts

- Good student discount: You have good grades.

- Driver training discount: You can take a driver education course approved by your auto insurance company.

- Distant student discount: You don’t have access to a car, but you remain on your parents’ auto policy while you’re away at college.