Predicting auto insurance premiums is challenging. The insurance company’s willingness to take on risk, the type of coverage you seek, the type of car you drive, and hundreds of other factors all affect your premium.

Even though practically every insurance company will have your information on file, your pricing will vary, so it’s in your best interest to shop around. You just need to put in some time researching and reading reviews to figure out which options are most likely to suit your needs.

Understanding what you’re paying for and being prepared for the unexpected are two additional benefits of having some basic car insurance knowledge. The average car insurance rates for teens, young drivers, adults, and seniors, as well as the average auto insurance rates in each state, are broken down below for your convenience.

In this method, you may quickly and conveniently shop around for the best car insurance rate.

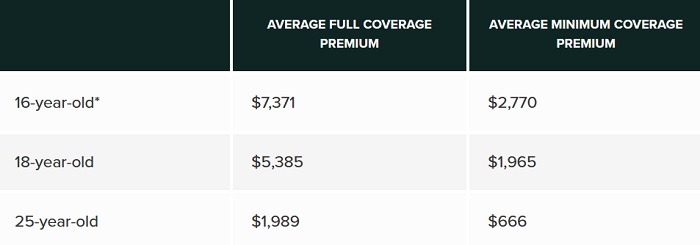

Minimum and Full Coverage Rates for Teens and Young Drivers

Although you can’t change your age, it does have a big impact on the auto insurance premiums you can get. Insurance premiums are typically higher for young drivers and teenagers, especially those under the age of 25.

Young drivers have less experience and are more likely to be involved in accidents, which makes sense. Car accidents are the second biggest cause of death among young people in the United States, according to data from the Centers for Disease Control.

For instance, the cost of full coverage insurance for a driver under the age of 25 is significantly more than that for a motorist under the age of 18. According to the Insurance Information Institute, adding a child to a parent’s auto policy is typically more cost-effective than having a kid have their own policy. Insurance companies charge different rates for young drivers.

Rates for 16-year-olds, 18-year-olds, and 25-year-olds are compared annually on average below.

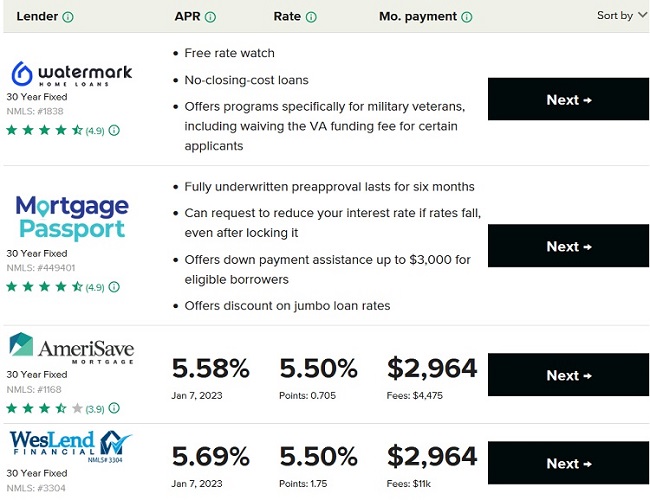

Current Mortgage Rates for January

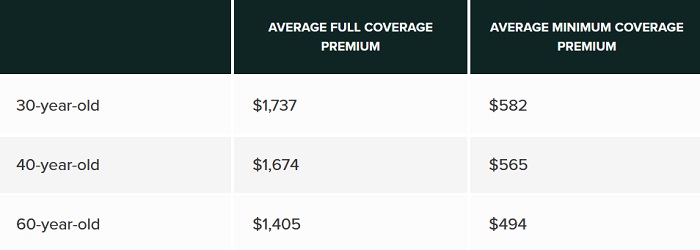

Minimum and Full Coverage Rates for Adults and Seniors

If you have a clean driving record as you become older, your insurance premiums should go down. Taking advantage of multi-policy and safe driving discounts can help older drivers save even more money on their premiums.

Find below a comparison of the typical yearly costs for both adults and the elderly.

How to Shop for Car Insurance

Finding the best car insurance policy for you comes next after doing your research. Here are some guidelines to follow while looking for car insurance, as well as some pointers on how to get the best rate available.

Gather Your Information

Whether you’re getting a quote online or through an insurance agent, it’s wise to be prepared when searching for auto coverage. To get a car insurance policy, you should know the following facts in general:

- All drivers on the policy, including their names and ages

- Provide the address of the location where the car will be kept.

- All drivers covered by the policy’s license numbers

- The policy’s drivers’ driving records

- VINs of each vehicle covered by the policy

- All drivers listed on the policy must have proof of prior car insurance.

Figure Out the Minimum Auto Coverage You Need

Auto insurance coverage must fulfill certain minimum standards in almost every state. This could just be liability coverage in several states. However, liability and additional coverages, like as PIP and Uninsured/underinsured Motorist coverage, may be mandatory in some states.

Decide if You Want Extra Coverage

Your state mandates a minimum level of auto insurance coverage for drivers who own cars. After you reach that threshold, it is entirely up to you to determine the level of additional coverage that you require.

Most of the time, your auto insurance company will demand that you carry full coverage if you have an auto loan (liability, comprehensive, and collision insurance).

What you drive, where you live, and how much you drive are just a few of the factors that affect how much auto coverage you should feel comfortable with.

Many of the professionals we consulted stressed the need of purchasing as much coverage as is financially feasible. Schmitt stresses the need of having adequate insurance coverage, stating that it is never a smart idea to sacrifice coverage for a lower cost.

Compare Quotes

Compare car insurance quotes from different providers once you’ve settled on the specifics of the coverage you require.

There are a few ways to obtain car insurance quotes: through a “captive” insurance agent who works exclusively for one company, through an independent agent who represents numerous insurance companies, directly from the website of a car insurer, or through an internet comparison engine. The easiest approach to determine if your current insurer is giving you the best rate is to do some comparison shopping.

It’s time to make a change if your current rate isn’t competitive for the level of coverage you require.