One of the simplest methods to reduce your insurance prices is to “bundle”, or get both auto and home insurance from the same company. That’s because bundling your home and auto insurance can save you as much as 25% on your premiums from most major insurance companies.

Get a quote to discover if bundling your auto and home insurance with the same company can save you money. Bundling isn’t always beneficial, though, and it might not be appropriate for you.

It’s always a good idea to compare prices, and you may find that purchasing two separate plans from two different providers is actually the more cost-effective option.

A 2018 research by J.D. Power found that 20% of auto insurance customers who also have home insurance do not bundle their policies.

The benefits of bundling your auto and home insurance with the same company are discussed below.

How Much Can You Save By Bundling Insurance?

The savings you’ll receive from a multi-policy discount are the biggest advantage of bundling your car and home insurance. Depending on your coverage and the insurance, you may be able to save a few hundred dollars by bundling.

You’re in a great position to bundle if you own a home and a car. The savings from bundling might add up quickly if you have more than one car or home.

Travelers Insurance, for instance, has an average car insurance premium of $1,429 and an average homeowners insurance cost of $1,269. You could typically save about $143 on your auto insurance premiums if you qualified for a 10% discount when bundling.

Which Companies Offer Home & Auto Bundles?

Having numerous policies with the same insurance company might save you anywhere from 5% to 25% on your premiums. However, when it comes to home and auto insurance, the biggest reduction doesn’t always equate to the cheapest rate.

You can think of a discount as a surcharge’s inverse. Either they’re charging you less because of something you did or some quality you possess, or they’re charging you more because you lack that characteristic.

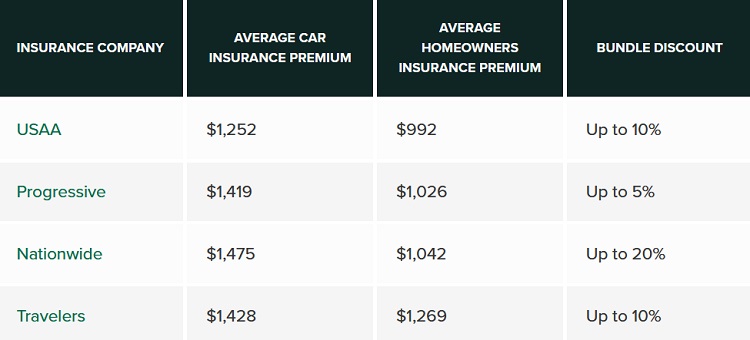

To illustrate, USAA has the lowest average discount but the lowest total combined premium at $2,244, making it the most cost-effective option. Nationwide is one of the more expensive bundles, averaging $2,500 per year, although it does give a 20% discount for bundling two or more plans.

Companies with reduced rates and multi-policy discounts include the following:

How to Get the Best Deal on a Home and Auto Insurance Bundle

You can save money annually by bundling your home and auto insurance, and it can be more convenient to deal with one company for all of your insurance needs. However, even a substantial multi-policy discount does not always translate into the lowest pricing. Home and auto insurance can be purchased in the following ways:

Compare Quotes

To begin, you should tally up the costs of your current home and auto insurance, as well as your current car payment, and have this information on hand when comparing bundle prices. In order to obtain the best rate and coverage, you need collect at least three to five quotes, both with and without bundling.

Even with a significant discount, a $1,000 policy could still end up costing more than a $700 policy without a discount. Look at the ultimate rate before being seduced by discounts.

Ask About Your Deductible

Some insurance companies reward customers who bundle their auto and home insurance by waiving the deductible for claims that affect both the car and the home, as well as sending the policyholder just one monthly statement.

To give one example, Progressive provides this option. If you get both your home and auto insurance from the same company, you should inquire about the deductibles involved.

Shop Around Regularly

To make sure you’re not overpaying or underinsured, the majority of the experts we spoke with advise shopping around for home and auto insurance at least once a year.

When comparing insurance quotes, price is one of many key factors to take into account. To ensure that an insurance provider is dependable and financially secure, you can also check out its customer satisfaction ratings, web reviews, and financial strength ratings.

Asking about the discount you can receive for purchasing many policies from the same company is worthwhile, but it shouldn’t be the deciding factor. The best rate, not the best discount, is what you want to make sure of.